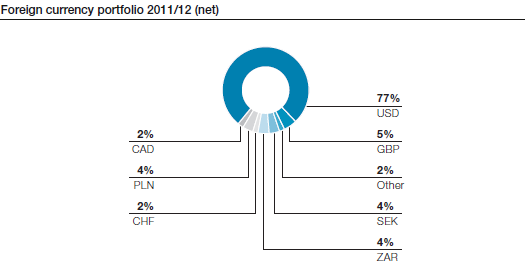

The largest currency position in the Group arises from raw materials purchases in USD and to a lesser degree from exports to the “non-euro area.”

An initial hedge is provided by naturally covered items where, for example, trade receivables in USD are offset by liabilities for the purchase of raw materials (USD netting). The use of derivative hedging instruments is another possibility. voestalpine AG hedges budgeted (net) foreign currency payments over the next 12 months. Longer-term hedging occurs only for contracted projects. The hedging ratio is between 50% and 100%. The further in the future the cash flow lies, the lower the hedging ratio.

The net requirement for USD was USD 1,555.1 million in the business year 2011/12. The increase compared to the previous year (USD 1,143.9 million) was due to the rise in quantities and prices of raw materials purchased as well as higher sales prices. The remaining foreign currency exposure, resulting primarily from exports to the “non-euro area” and raw material purchases, is significantly lower than the USD risk.

Based on the Value-at-Risk calculation, as of March 31, 2012, the risks for all open positions for the upcoming business year are as follows:

| (XLS:) Download |

|

Undiversified |

|

USD |

|

PLN |

|

ZAR |

|

GBP |

|

CAD |

|

CHF |

|

SEK |

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Position1 |

|

–397.58 |

|

–22.09 |

|

32.81 |

|

17.75 |

|

7.55 |

|

5.91 |

|

26.51 |

|

16.17 |

|

VaR (95%/year) |

|

67.49 |

|

3.68 |

|

6.80 |

|

2.31 |

|

1.24 |

|

1.09 |

|

3.09 |

|

2.84 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Unhedged planned positions for the business year 2012/13 |

|

|

|

|

|

In millions of euros | ||||||||||

Taking into account the correlation between the different currencies, the resulting portfolio risk is EUR 66.0 million (March 31, 2011: EUR 69.0 million).