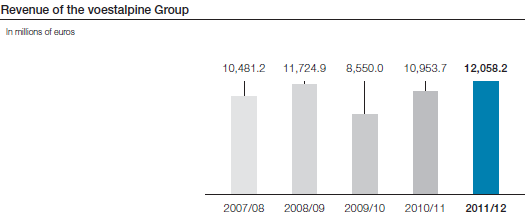

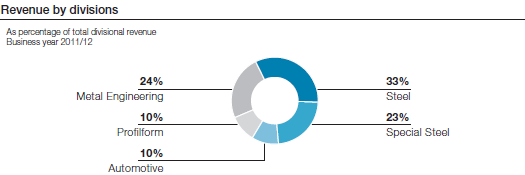

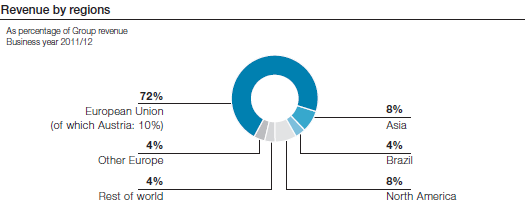

Against the backdrop of an overall economic environment that was challenging in all respects, the voestalpine Group’s revenue in the business year 2011/12 nevertheless reached EUR 12,058.2 million—a new record. Compared to the previous year (EUR 10,953.7 million), this equals revenue growth of 10.1%, with all the divisions contributing to the increase.

In relative terms, the biggest gain was reported by the Automotive Division at 17.7%. Even the Steel Division, which was operating in a particularly difficult market environment, recorded significantly higher revenue (a plus of 7.6%).

In terms of earnings, however, last year’s figure remained out of reach. On one hand, this was due to the fact that the Steel Division’s earnings declined because of the situation of the economy and, on the other, because of the relevant factor that both EBITDA and EBIT in the Metal Engineering Division (until March 31, 2012 Railway Systems Division) were severely impacted by negative non-recurring effects (provisions for the closure of rail production in Duisburg and for the antitrust proceedings relative to railway superstructure material).

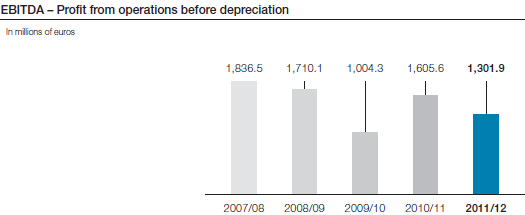

Nevertheless, the voestalpine Group reported EBITDA totaling EUR 1,301.9 million and an EBITDA margin of 10.8% in the business year 2011/12. Compared to the previous year (EUR 1,605.6 million), this corresponds to a drop in EBITDA (in absolute figures) of 18.9%. Without the non-recurring effects amounting to EUR 205.0 million, however, EBITDA was EUR 1,506.9 million and the EBITDA margin was 12.5%, which is only slightly below last year’s level.

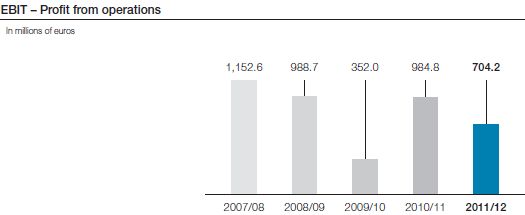

The picture is similar with regard to the operating result: taking the non-recurring effects into account, EBIT is EUR 704.2 million, 28.5% below the previous year’s figure (EUR 984.8 million). Without the impact of the non-recurring effects in the amount of EUR 205.0 million, EBIT in the business year 2011/12 is EUR 909.2 million, only 7.7% below the previous year’s earnings.

Measured against the development of the overall market, this relatively minor decline in earnings is primarily due to the stable performance of the processing divisions (Special Steel, Metal Engineering, and Automotive), while the Steel Division’s profit from operations was substantially below the previous year’s figure because of the difficult market environment, particularly in the third quarter of the business year.

In this context, it should be pointed out that the final quarter showed a more positive momentum than the previous quarter, including in the Steel Division, thus enabling a return to full capacity utilization. Nevertheless, viewing the Group as a whole, earnings in the second half of 2011/12 lagged behind both the first half of the year and the comparative period of the previous year.

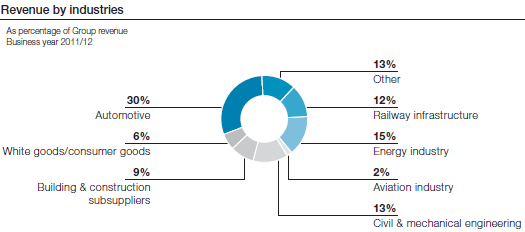

Overall, in the business year 2011/12, due to its long value chain and leading position with regard to technology, innovation, and quality compared to its competition and the significantly lower level of volatility in its earnings performance during the year, the voestalpine Group ultimately experienced only a slight decline of the result (without taking the non-recurring effects into account) compared to the previous year.

Business performance of the voestalpine Group – In accordance with IFRS, all figures after application of the purchase price allocation (ppa).