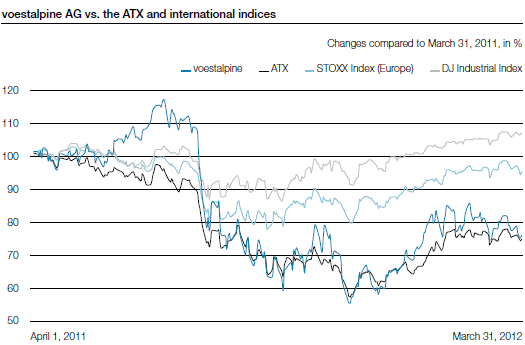

After a several-week period of lateral movement in the early part of the business year and a substantial gain in the share price when the 2010/11 operating results were published, from the summer of 2011 onward, the development of the voestalpine share faced serious headwinds in the wake of growing fears about the economy arising from the European debt crisis and the further course of the euro. It followed the general trend of cyclical industrial stocks in Europe, which was amplified by the proximity of the Austrian capital market to Eastern Europe.

It was not until the end of the calendar year 2011 that the mood on the European stock exchanges brightened somewhat. The price of the voestalpine share also recovered, albeit without coming anywhere near its level during the first months of the business year. Measured against the share’s initial value at the beginning of the year, this means a price drop of about 24% from EUR 33.13 to EUR 25.22.

| (XLS:) Download |

|

|

EUR 307,132,044.75 divided into | |

|

|

|

Shares in proprietary possession |

|

Class of shares |

|

Ordinary bearer shares |

|

Stock identification number |

|

93750 (Vienna Stock Exchange) |

|

ISIN |

|

AT0000937503 |

|

Reuters |

|

VOES.VI |

|

Bloomberg |

|

VOE AV |

| (XLS:) Download |

|

Prices (as of end of day) |

|

|

|

Share price high April 2011 to March 2012 |

|

EUR 38.90 |

|

Share price low April 2011 to March 2012 |

|

EUR 18.38 |

|

Share price as of March 31, 2012 |

|

EUR 25.22 |

|

Initial offering price (IPO) October 1995 |

|

EUR 5.18 |

|

All-time high price (July 12, 2007) |

|

EUR 66.11 |

|

Market capitalization as of March 31, 2012* |

|

EUR 4,255,017,003.53 |

|

|

|

|

|

* Based on total number of shares minus repurchased shares. | ||

| (XLS:) Download |

|

Business year 2011/12 |

|

|

|

Earnings per share |

|

EUR 1.98 |

|

Dividend per share |

|

EUR 0.80* |

|

Book value per share |

|

EUR 28.24 |

|

|

|

|

|

* As proposed to the Annual General Shareholders’ Meeting. | ||