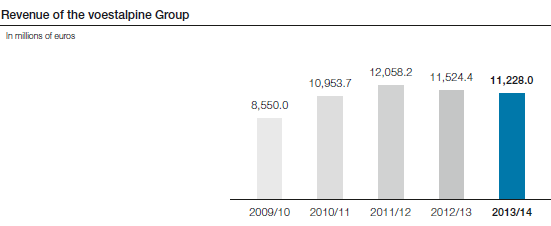

Despite the fact that for much of the business year 2013/14, economic conditions remained challenging, the voestalpine Group again achieved a solid development of the most important key figures. Although delivery volumes in the Steel Division grew compared to the last business year and quantities in the Metal Engineering and Special Steel Divisions fell only slightly, revenue declined by 2.6% from EUR 11,524.4 million in the business year 2012/13 to EUR 11,228.0 million in the current reporting period. The primary reason for this was a declining price level overall, triggered by dropping pre-material costs and continuing intense competition. With the exception of the Metal Forming Division, where revenue increased by 2.0%, this decline affected all other divisions equally.

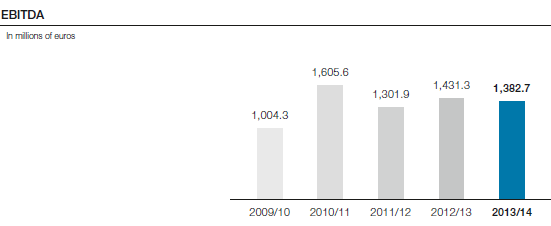

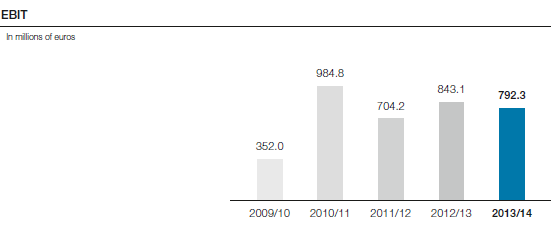

A highly differentiated picture emerges, when one compares the development in the key reporting categories with that of the previous year. The decline in EBITDA and EBIT is due largely to an economic trend in the energy sector that continues to be critical. This applies, on one hand, mainly to the Special Steel Division, which was faced with sustained weakness in the energy engineering industry, and, on the other, to the heavy plate business segment (Steel Division), which was also negatively affected by the steep decline of awards for pipeline construction projects. Against this backdrop, the Steel Division reports a noticeable decline in results in the period under review (EBITDA –12.0%, EBIT –25.5%), while the results of the Special Steel Division (EBITDA –2.3%, EBIT +1.2%) and the Metal Engineering Division (EBITDA +0.6%, EBIT –0.2%) are largely at the previous year’s level. It is satisfactory that the Metal Forming Division made noticeable gains in both EBITDA (+8.2%) and EBIT (+10.2%). As a result of this performance by the individual divisions, the voestalpine Group achieved an operating result (EBITDA) of EUR 1,382.7 million in the business year 2013/14, which is 3.4% below the previous year’s figure of EUR 1,431.3 million. With a minus of 6.0%, the decrease of profit from operations (EBIT) from EUR 843.1 million to EUR 792.3 million was somewhat more substantial.

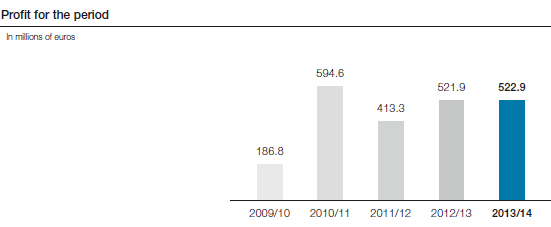

Profit before tax and profit for the period

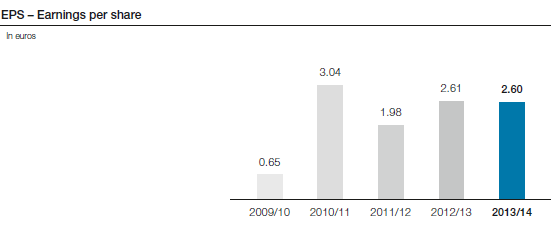

The fact that at EUR 656.0 million profit before tax in the business year 2013/14 still remained at a stable level (previous year: EUR 654.7 million) is the result of significantly lower financing costs due to the low interest rates in the current reporting period as well as repayment of a corporate bond with a coupon rate of 8.75%, which was issued during the financial crisis in the spring of 2009. The tax rate of 20.3% has remained the same as in the previous year so that profit for the period in the business year 2013/14 was EUR 522.9 million, thus remaining at the same level as in the previous year (EUR 521.9 million). As a result, earnings per share (EPS) of EUR 2.60 likewise remained practically unchanged compared to last year’s figure (EUR 2.61).