|

Key figures of the Steel Division |

|

|||||

|

In millions of euros |

|

2012/131 |

|

2013/14 |

|

Change in % |

|

|

|

|

|

|

|

|

|

Revenue |

|

3,921.7 |

|

3,809.7 |

|

–2.9 |

|

|

446.3 |

|

392.9 |

|

–12.0 |

|

|

|

11.4% |

|

10.3% |

|

|

|

|

|

214.9 |

|

160.0 |

|

–25.5 |

|

|

|

5.5% |

|

4.2% |

|

|

|

|

Employees (full-time equivalent) |

|

10,676 |

|

11,192 |

|

4.8 |

|

|

|

|

|

|

|

|

|

1 Business year 2012/13 retroactively adjusted in accordance with IAS 19 (revised). |

||||||

The intense competition in the European steel industry is reflected in the development of the Steel Division’s key performance indicators. Despite continually rising demand during the business year 2013/14, which resulted in a record 5.7 million tons in crude steel production as well as record delivery volumes of 5.1 million tons, the division’s key performance indicators were considerably below the previous year’s figures. Prices, which were already trending downward in 2012/13, again weakened significantly during the past business year. Similarly, there was no respite as far as the cost situation was concerned. While the largest cost component with regard to raw materials, iron ore, remained at a relatively high level, slightly falling prices for coal, coke, scrap, and alloys curtailed manufacturing costs somewhat. However, since prices were also dropping, this did not result in any positive effects on margins. Against this backdrop, revenue went down by 2.9% from EUR 3,921.7 million in the business year 2012/13 to EUR 3,809.7 million in the business year 2013/14. In addition to tougher pricing conditions, the less favorable product mix in the heavy plate business segment resulting from the absence of major line pipe projects had an additional adverse impact on earnings in the past business year, as did non-recurring effects amounting to EUR 10 million in the second quarter of 2013/14 for early cancellation of an unfavorable, long-term contractual relationship. Consequently, the operating result (EBITDA) shrank by 12.0% from EUR 446.3 million in the business year 2012/13 to EUR 392.9 million in the current reporting period, with the EBITDA margin dipping from 11.4% to 10.3%. Profit from operations (EBIT) dropped off more sharply by 25.5%, going from EUR 214.9 million to EUR 160.0 million. This corresponds to an EBIT margin of 4.2%, compared to an EBIT margin of 5.5% in the previous year.

|

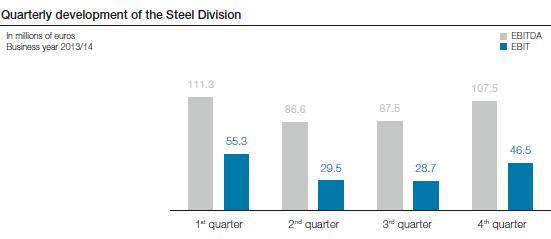

Quarterly development of the Steel Division |

|

|

|

|||||||

|

In millions of euros |

|

1st quarter 2013/14 |

|

2nd quarter 2013/14 |

|

3rd quarter 2013/14 |

|

4th quarter 2013/14 |

|

BY 2013/14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

989.8 |

|

938.5 |

|

886.8 |

|

994.6 |

|

3,809.7 |

|

|

111.3 |

|

86.6 |

|

87.5 |

|

107.5 |

|

392.9 |

|

|

|

11.2% |

|

9.2% |

|

9.9% |

|

10.8% |

|

10.3% |

|

|

|

55.3 |

|

29.5 |

|

28.7 |

|

46.5 |

|

160.0 |

|

|

|

5.6% |

|

3.1% |

|

3.2% |

|

4.7% |

|

4.2% |

|

|

Employees (full-time equivalent) |

|

10,805 |

|

11,026 |

|

10,862 |

|

11,192 |

|

11,192 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The comparison of the year’s quarters to the immediately preceding quarter ran counter to the year-to-year comparison, with a clear upward trend becoming apparent most recently. Revenue rose by 12.2% from EUR 886.8 million in the third quarter to EUR 994.6 million in the fourth quarter of 2013/14; this is primarily due to increased delivery volumes and a product mix that improved concurrently, with the general price level remaining mostly stable. Even though iron ore prices on the spot market have been falling since the beginning of the fourth quarter of 2013/14, the cost basis went down only marginally as the effect is delayed by two to three months. As a result of this development, EBITDA posted a gain of 22.9%, going from EUR 87.5 million in the third quarter to EUR 107.5 million in the fourth quarter of 2013/14, with the EBITDA margin improving from 9.9% in the immediately preceding quarter to 10.8%. In the same period, EBIT surged by 62.0% from EUR 28.7 million to EUR 46.5 million, with the EBIT margin going from 3.2% to 4.7%.

The number of employees (FTE) in the Steel Division as of the end of the fourth quarter of the business year 2013/14 was 11,192, 4.8% higher than as of March 31, 2013 (10,676 FTEs).