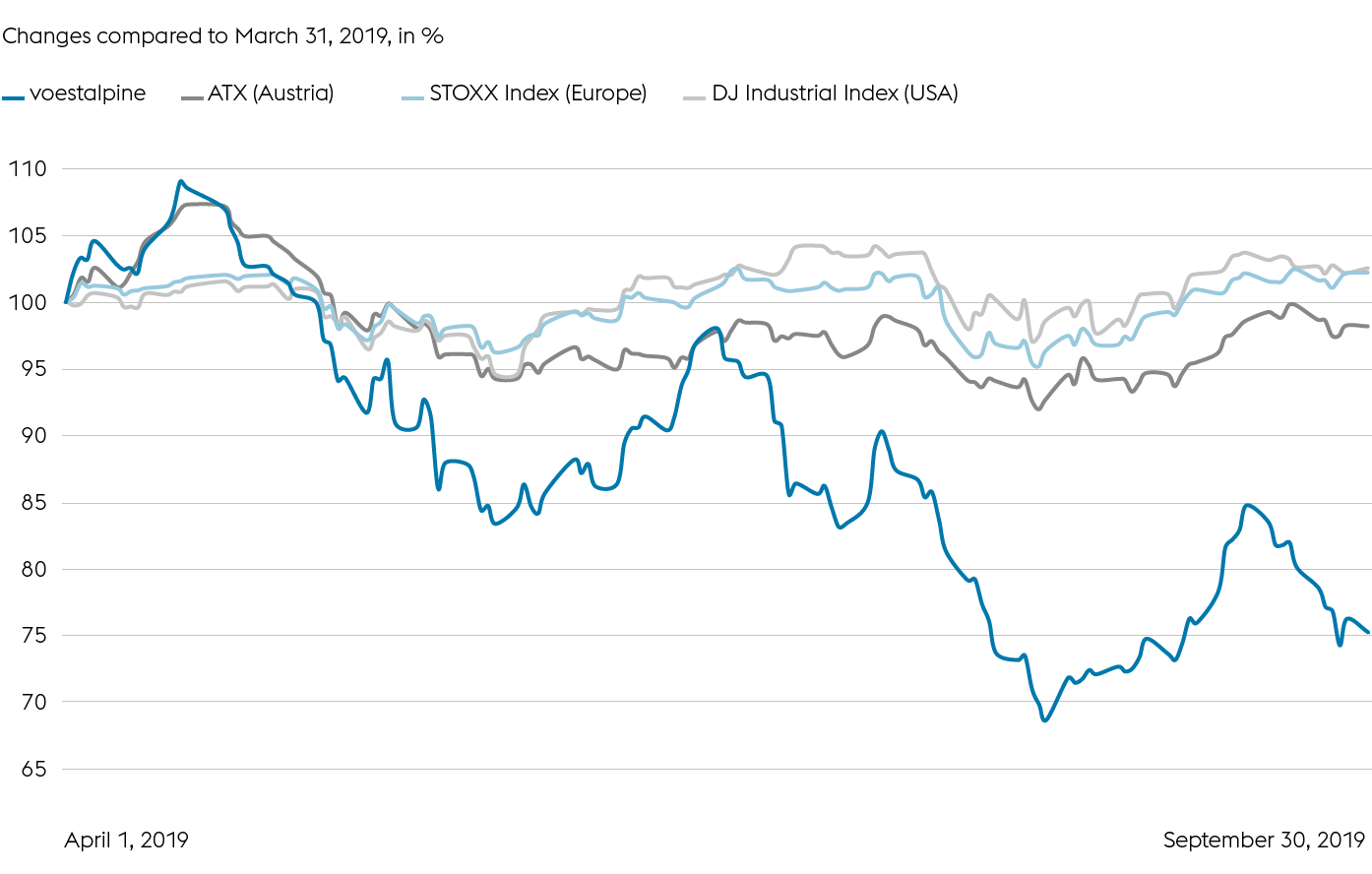

voestalpine AG VS. The ATX and international indices

At the start of the 2018 calendar year—i.e. right at the time at which the U.S. launched its trade wars against the rest of the world—the precursor indicators in Europe began to weaken, putting increasing pressure on the shares of companies sensitive to macroeconomic developments. The trade war between the United States and China has escalated in the 2019 calendar year. Leading economic indicators, such as the Ifo Business Climate Index or the Purchasing Managers’ Indices (PMI) for the processing industries in Europe, have declined yet further due to the resulting uncertainties, especially in export-driven economies. The initial impact of these developments on the global economy already made themselves felt during the second half of the 2018 calendar year, first in China and then in Europe as well. While China counteracted the decline in both consumer and export-driven segments through economic growth measures in the construction and infrastructure industry, the economic headwinds in Europe have intensified substantially in the course of the 2019 calendar year. The economic downturn has had its greatest impact in the European steel sector. In this industry, the decline in demand has intensified what were already challenging structural conditions, for example, the rising cost of CO2 allowances as well as ineffective steps to limit surging steel imports. To make matters worse, the economic environment in downstream processing has become increasingly difficult too.

Capital market players responded by issuing lower earnings forecasts which, in turn, intensified the downward spiral of voestalpine’s share price in the first six months of the business year 2019/20, thus prolonging the previous year’s trend. While the ATX trended laterally during this period, ending in minor negative territory of –2% at the end of September 2019, the price of voestalpine’s stock was highly volatile during the entire period. Regularly recurring, geopolitical uncertainties—such as the growth of Italy’s sovereign debt, the uncertain resolution of the Brexit, the U.S.’s conflict with Iran, the attacks on the oil industry in the Middle East, etc.—that pushed fears of a recession into the forefront of investors’ minds further aggravated the large fluctuations. Against this backdrop, the voestalpine share had to contend with a loss of just under 25% in the first half of the business year 2019/20. While its price at the start of the business year still was EUR 28.04, its closing price as of the end of September 2019 was EUR 21.08. In contrast to the ATX, the Dow Jones Industrial and the STOXX Index Europe even followed a slightly positive trend in the same period.

Share page