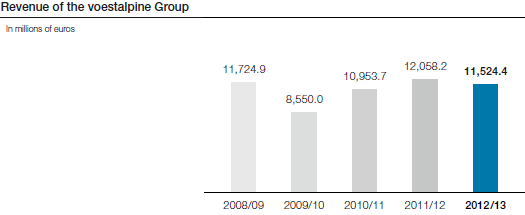

With a decline of 4.4% down to EUR 11,524.4 million (compared to EUR 12,058.2 million in the previous year), in a year-to-year comparison, the revenue of the voestalpine Group reflects the weakening of the global economic situation on one hand and, on the other, the lower pre-material costs.

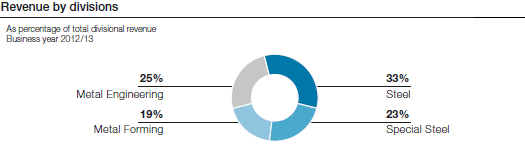

The decrease in revenue impacted all the divisions, although at –1.4%, the drop in the Metal Engineering Division was kept within narrow limits.

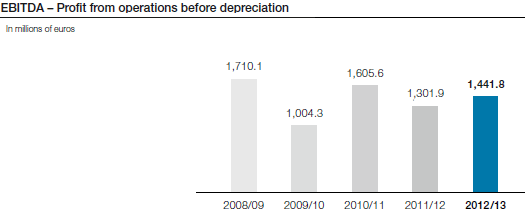

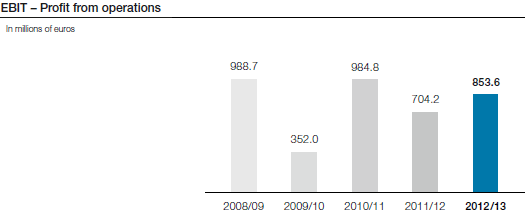

As far as earnings are concerned, the Group experienced growth in all categories—in some cases very significant growth—compared to the previous year. In this context, however, when comparing the figures of the year under review to those of the business year 2011/12, it should be noted that the latter business year was impacted by negative non-recurring effects in the form of provisions amounting to EUR 205.0 million set aside for risks resulting from the antitrust proceedings in Germany and closure of the standard rail production facility in Duisburg.

The operating result (EBITDA) in 2012/13 was EUR 1,441.8 million, an increase of 10.7% compared to the previous year’s figure of EUR 1,301.9 million.

Profit from operations (EBIT) experienced a boost of 21.2%, going from EUR 704.2 million in the business year 2011/12 to EUR 853.6 million in the year under review.

The non-recurring effect of the previously mentioned provisions amounting EUR 205.0 million in the business year 2011/12 impacted solely the Metal Engineering Division; therefore, this division’s earnings show significant growth in a year-to-year comparison. But even adjusted for this effect, the division was able to again surpass the already very high previous year’s figures both with regard to EBITDA and EBIT.

In the other divisions, development of earnings in a year-to-year comparison were varied. While the Steel Division experienced only marginal losses (EBITDA –1.6%, EBIT –3.6%) and the Metal Forming Division’s figures fell moderately (EBITDA –6.7%, EBIT –9.5%), the Special Steel Division’s results fell considerably short of the outstanding results of the business year 2011/12 (EBITDA –14.2%, EBIT –18.1%).

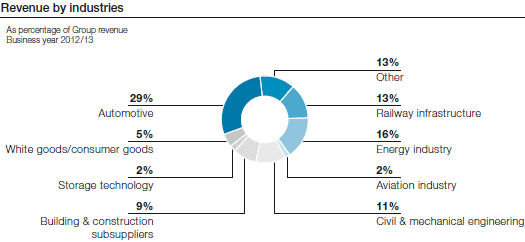

Viewed overall, considering the economic environment, the performance of the voestalpine Group has been gratifying, including in the comparison to other companies in the industry. This is the result of the Group’s broad-based geographical and sectoral set-up, with its combination of steel production and downstream processing of steel—and increasingly other materials as well—and its focus on technologically sophisticated market segments. The performance of earnings—especially in a challenging economic environment—confirms that the strategy of extending the value chain based on premium products, which has been pursued consistently for the past twelve years, was the right path to take.