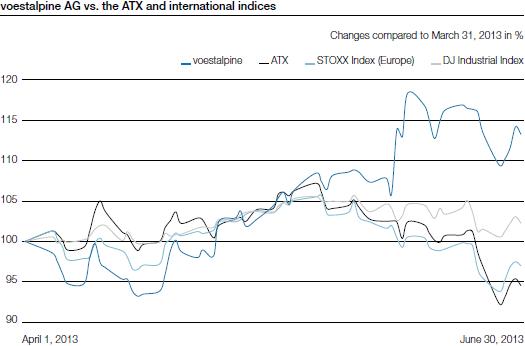

Price development of the voestalpine share

In a period when the European capital markets were trending toward lateral movement, the voestalpine share performed very positively in the first quarter of 2013/14 in comparison. Within three months, it not only achieved a significant increase in value, but, for the first time in quite a while, it was successful in outstripping the most important indices (Stoxx Index Europe, Dow Jones

Industrial Index, and ATX) by a healthy margin. The primary reason for the increase in the share’s price were the results for the fourth quarter of 2012/13 that were published on June 5, 2013 and were excellent considering the difficult market environment. Up to this point in time, the voestalpine AG share had been more or less in step with the aforementioned indices. As of June 30, 2013, however, its price of EUR 27.13 was significantly higher than its price at the end of the immediately preceding quarter (EUR 23.96).

Share information

| Download |

|

Share capital |

|

EUR 313,309,235.65 divided into |

|

Shares in proprietary possession as of June 30, 2013 |

|

28,597 shares |

|

Class of shares |

|

Ordinary bearer shares |

|

Stock identification number |

|

93750 (Vienna Stock Exchange) |

|

ISIN |

|

AT0000937503 |

|

Reuters |

|

VOES.VI |

|

Bloomberg |

|

VOE AV |

|

Prices (as of end of day) |

|

|

|

Share price high April 2013 to June 2013 |

|

EUR 28.35 |

|

Share price low April 2013 to June 2013 |

|

EUR 22.34 |

|

Share price as of June 30, 2013 |

|

EUR 27.13 |

|

Initial offering price (IPO) October 1995 |

|

EUR 5.18 |

|

All-time high price (July 12, 2007) |

|

EUR 66.11 |

|

Market capitalization as of June 30, 2013* |

|

EUR 4,677,769,955.58 |

|

|

|

|

|

* Based on total number of shares minus repurchased shares. | ||

|

Business year 2012/13 |

|

|

|

Earnings per share |

|

EUR 2.61 |

|

Dividend per share |

|

EUR 0.90 |

|

Book value per share |

|

EUR 29.06 |